1. 利用以下表格计算收入和支出,比较数目,了解自己花费习惯和问题,为今后保证每月有盈余打下基础:

- Consumer Equity Sheet消费资产表: 总结出你的净资产。

- Quick-Start Budget Form快速入门预算表:计算出每月生活必需品的花销。

- Income Sources Recap收入来源表: 列出所有收入来源。

- Lump Sum Payment Form整笔付款表: 计算并不是每月都需要的花销。

- Recommended Percentages建议比例表: 作者建议各类花销的所占比例。

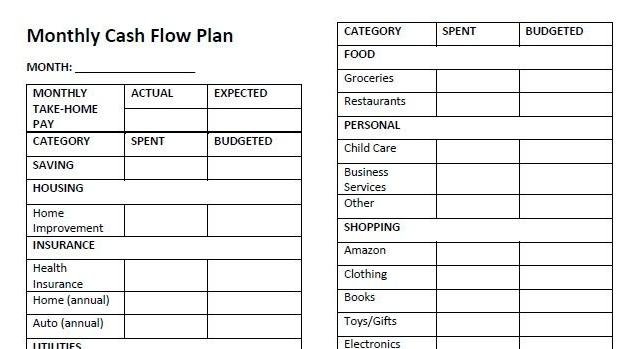

- Monthly Cash Flow Plan每月现金流预算表: 设置每月现金流,把收入的每一分钱都安排在预算表格里。

- Allocated Spending Plan分配支出计划表: 把每次收到薪水(一月多次)之后的每一分钱安排在表格里。

- Irregular Income Planning不定期收入表: 列出不定期收入

- 我的每月现金流预算表以供参考:

2. 每月现金流计划表格有绝对主导权,一定要严格遵守。每个月开始之前打印出来写好预算,放在明显的地方,随时记录开销。

3. 七小步之第一步:用最快的速度存$1000现金应急存款,存放在安全需要时可以拿但是不方便拿的地方。

CHAPTER 6: WALK BEFORE YOU RUN: SAVE$1000

Key Concept #1 :Proceed One Step at a Time... but Keep Walking

1. The power of focus and priority is what causes our baby steps to work.

2. Be patient and don't try to do everything at once, or the progress can be very slow. Do the baby steps in order.

3. Balance Your Checkbook.

- So you know how much you have and where it’s at.

- Subtracting both checks and withdrawals and adding deposits, as they’re made, keep your checkbook balanced correctly.

- Consumer Equity Sheet: What's your net worth? Find out with this form by determining how much you owe versus how much value each asset has.

4. A Basic Quickie Budget, follow these rules:

- Every dollar of your income should be allocated to some category on budget.

- Initially, your “savings” will go to building up an emergency fund. Later, this “savings” money needs to be allocated to items that need periodic replacement.

- Fill in the amount for each subcategory under “subtotal” and then the total for each main category under “total”.

- The line “percent of take-home pay” is the percentage of take-home pay that category represents.

- Put an asterisk beside every item that should be part of your “envelope system”. Envelope system basically works like this: Put the amount in the monthly budget for a particular category in an available in cash. Spend money out of that envelope for purchases in that category — and don't cheat by borrowing from other envelopes, or switch money from envelope to envelope through the month.

- Quick-Start Budget Form: A start to show you how much money you need every month to cover necessities

- Income Sources Recap: If you work multiple jobs or have other streams of income, you can get them all down in one place here.

- Lump Sum Payment Form: Use this form to help you calculate and save for expenses that happen on a non-monthly basis.

- Recommended Percentages: How much do you need to budget for groceries? This form outlines Dave's recommended percentages for each category, making it easier to set up your budget.

- Monthly Cash Flow Plan: Use the Monthly Cash Flow form to set up your basic monthly budget. This form helps you prioritize while giving every dollar a name.

5. The Bigger Budget Picture

- The Allocated Spending Plan Form assumes that you get paid once a week. If you get paid once every two weeks, just use fewer columns. Here are some basic rules:

- Each column is a pay period.

- Date the pay period columns, then enter the total income for that period. As you allocate your paycheck to an item, put the remaining total balance to the right of the slash.

- Make sure you “spend” your entire paycheck before you get paid ... on paper.

- Many people have irregular incomes, use “irregular income planning” form.

- Eventually, after your emergency fund is fully funded, you can start saving for certain items.

- Allocated Spending Plan: Give every dollar a name. Use this form to break down each paycheck and tell your money where to go.

- Irregular Income Planning: Many of us have irregular incomes. If you're self-employed or work on commission, this form will help you plan for your expenses.

Key Concept #2:Make a Written Budget the “Boss” of Your Spending

1. Set up a written budget, every month.

- Give every dollar of your income a name before the month begins-zero-based budget.

- You MUST become current.

- If you are married, agree on the budget with your spouse.

- Once the budget is agreed on and is in writing that you will never do anything with money that is not on the paper.

- If something comes up in the middle of the month that causes the budget to need changing, you can change the budget only if (1) both spouses agree to the change (2) you must still balance your budget - so that your income minus your outgo still equals zero.

2. You will have to be current with all your creditors.

- If you are behind on payments, the first goal will be to become current.

If you are far behind, do you necessities first. - Only when you are current with the necessities can you catch up on credit cards and student loans.

- After your current, have a written, agreed-on plan, have the obstacle course behind you, and a focused and intense, you are ready to follow the right priorities. Here we go.

Key Concept #3:Establish a Rainy-Day Fund

Baby Step One: Save $1000 cash as a starter emergency fund FAST.

- If your family income is under $20,000 a year, start with an emergency found out $500 and build up.

- If you spend any of these emergency fund, immediately go back to this baby steps and the red planet that fund.

Key Concept #4:Hide Your Emergency Money in an “Available” Location

- Don’t touch it and keep it in “liquid funds”

- Keep it in a safe, “liquid,” accessible-but-not-readily-handy location.

- If you are at Baby Step Two in the next chapter, and you use some money from your emergency fund to fix the alternator, stop Step Two and return to Step One until the full $1000 is replenished.

读书笔记的思维导图:

结合书和练习册一起看,思路更清晰。(亚马逊上略贵,可以在一些二手书网站上买旧书更划算)。

君君提示:你也可以发布优质内容,点此查看详情 >>

本文著作权归作者本人和北美省钱快报共同所有,未经许可不得转载。长文章仅代表作者看法,如有更多内容分享或是对文中观点有不同见解,省钱快报欢迎您的投稿。