*太长不看中文版*

1. 越早开始约有保障,享受时间带来的复利。

2. 把每个月税前收入的15%放入共同基金/互惠基金(Mutual Funds)。

- 把钱放入成长型股票共同基金(Growth-Stock Mutual Funds)作为长期投资。

- 利用公司提供的任何匹配计划,比如401K可以匹配3%的话,就把15%中的3%放到401K中。

- 每年放满罗斯个人退休金账户(Roth IRA)的最大限额。

3. 在Roth IRA中建立投资组合

- 寻找5年最好10年以上记录良好的基金。

- 把投资平均分成四份:

1) 成长和收入型基金Growth and Income Funds(Large Cap or Blue Chip Funds)

2) 成长型基金Growth Funds (Mid-Cap or Equity funds; an S&P Index Fund would also qualify)

3) 国际型基金International Funds (Foreign or Overseas Funds)

4) 进取型增长基金Aggressive Growth Funds (Small-Cap or Emerging Market Funds)

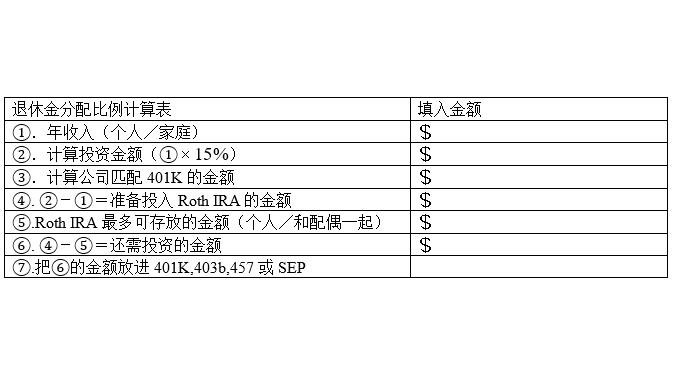

关于这个人投资组合也有一些不同的声音,具体怎么分配还要根据每个人的年纪,风险承受能力等等因素相关。 - 计算退休金分配比例

4. Monthly Retirement Planning每月退休金计划表:计算每月需要存多少钱才能达到你的退休金目标。

CHAPTER 9: MAXIMUM RETIREMENT INVESTING

Key Concept #1: Decide How You Want to Live in Your Retirement Years

- Retirement in Total Money Makeover is defined in terms of SECURITY. Security allows a person to make choices- work may be one of those choices.

- Retirement in Total Money Makeover also includes the concept of FINANCIAL DIGNITY.

Key Concept #2: Baby Step Four: Invest 15% of Your Income in Retirement

- Invest 15% of BEFORE-tax gross income annually toward retirement.

- It’s wiser to start investing for retirement as SOON AS POSSIBLE so the money has the maximum time to grow.

Key Concept #3: Invest for Retirement in Mutual Funds

- Use “Growth-Stock Mutual Funds” for long-term investing.

- Take advantage of any matching programs available to you. If your 401K matches the first 3% you invest, put your first 3% of your 15% in that fund.

- Use any tax advantages available. Put the maximum allowed into Roth IRA, since it grows TAX-FREE.

- In a ROTH IRA, you can choose where you put the money. How to choose the Growth-Stock Mutual Funds for Roth IRA investment:

1. Look for a good track record of winning for more than 5 years, preferably for more than 10 years.

2. Break down the retirement investing evenly across 4 types of funds:

* Growth and Income Funds(Large Cap or Blue Chip Funds)

* Growth Funds (Mid-Cap or Equity funds; an S&P Index Fund would also qualify)

* International Funds (Foreign or Overseas Funds)

* Aggressive Growth Funds (Small-Cap or Emerging Market Funds)

3. An article about Why Dave Ramsey Is Wrong On Mutual Funds - Calculating for Retirement Investing

Key Concept #4: Calculate What It Will Take for You to Retire

- You should aim at living off 8%. (Actually, this 8% is based on your funds earning 12% a year and inflation stealing about 4%.)

- Monthly Retirement Planning How much do you need to retire comfortably? Use this planning sheet to figure out how much you need to save each month for retirement.

- DON’T be panic if you cannot save this much money for your retirement. But DO be concerned enough to start investing for your retirement NOW.

- Start where you are. Work the steps of the plan. Get out of debt. Have $10,000 in an emergency fund. Start investing for your retirement. And don’t delay!

- It’s never too late to start.

- Baby Step Four is not “Get rich quickly.” The investing you do systematically and consistently over time will make you wealthy.

读书笔记的思维导图:

结合书和练习册一起看,思路更清晰。(亚马逊上略贵,可以在一些二手书网站上买旧书更划算)。

君君提示:你也可以发布优质内容,点此查看详情 >>

本文著作权归作者本人和北美省钱快报共同所有,未经许可不得转载。长文章仅代表作者看法,如有更多内容分享或是对文中观点有不同见解,省钱快报欢迎您的投稿。