*太长不看中文版*

- 为孩子从现在到大学的花销估价。

- 开设教育基金ESA (Educational Saving Account-Education IRA),年收入低于$200,000的家庭每年每个孩子最多$2,000。

- 如果开设ESA时孩子大于8岁,准备读更贵的本科或者以后要继续深造读研读博的话,还要开设529s。

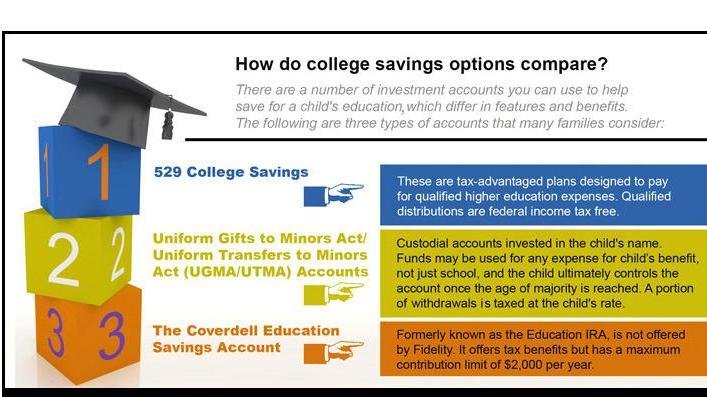

- 除了投资收益免税的账户外,还有一些类似 UGMA/UTMA 这种更灵活但投资收益需要交税的账户。

- Monthly College Planning大学基金存款月计划表: 根据孩子的年纪和所选大学的开销计算从现在起每月要存入多少钱。

- 各种账户对比表格见文末。

- 如果时间紧迫的话,可以试着降低学校标准,减少生活费开支,或者申请学校以及社会上的各种奖学金,助学金等等办法。

CHAPTER 10: COLLEGE FUNDING

Key Concept #1:Help Your Child Get a College Education

- Dave’s Rules for College

1. Research the cost of attending various types of schools.

2. Pay cash.

3. Avoid student loans.

4. Consider all your options. - Monthly College Planning: If you have kids, you're probably well aware of the rising cost of college. Planning is the secret to a college education without student loans. This form helps you determine how much you'll need to plan.

Key Concept #2:Get Smart About ESAs and 529s

- Baby Step Five: Save for College

- If you don’t have children, or your kids are grown and gone, you will simply skip this step. For everyone else, a college fund is a necessity.

- ESA (Educational Saving Account-Education IRA)

1.The ESA currently allows you to invest $2,000 per year, which is $166.67 per month, per child, if your household income is under $200,000 per year.

2.Start with the ESA because you can invest it anywhere, in any fund or any mix of funds, and changes it at will. It is the most flexible, and you have the most control.

3.If your child is over age 8 when you start an ESA, or you aspire to send your child to more expensive school or graduate school...the ESA is just a beginning. - 529s

1.If you need to set aside more than the ESA allows, or your income is more than $200,000a year, you will want to look at a 529 plan.

2.There are several types of 529 planes, the best is a “flexible” plan. It allows you to move your investment around periodically with a certain family of funds, a brand of mutual funds, like American Funds Group or Vanguard or Fidelity.

Key Concept #3:Get Creative If You’re Running Out of Time!

- Attend a cheaper college

- Live on campus and eat cafeteria food

- Work for a company that will help pay through college

- Look into companies with work-study programs.

- Check out military

- Check out National Guard

- Take a high-paying summer sales job

- Check into “underserved areas” programs

- Check into unclaimed scholarships

Education Plan Comparison 1 图片来自于 https://slideplayer.com/slide/15529421/,版权属于原作者

读书笔记的思维导图:

结合书和练习册一起看,思路更清晰。(亚马逊上略贵,可以在一些二手书网站上买旧书更划算)。

君君提示:你也可以发布优质内容,点此查看详情 >>

本文著作权归作者本人和北美省钱快报共同所有,未经许可不得转载。长文章仅代表作者看法,如有更多内容分享或是对文中观点有不同见解,省钱快报欢迎您的投稿。